By Jeff Wang

Information concerning inventory and its related accounts are required items that need to be reported on financial statements at the end of each financial period. In the United States, governing accounting boards allow corporations to use three different methods of accounting for the cost of inventory. Each different method produces varying information regarding the financial health of a company, which can be potentially utilized by a company to pay less taxes. The process of recording the cost of inventory should be standardized in order to maintain universal results which do not abuse tax loopholes or misrepresent the financial health of a company.

Problem Statement: the utilization of different methods in inventory accounting is not appropriate.

In the United States, under securities and commission law all organizations are required to report their most up-to-date financial information at the end of each financial period – be it in quarters, biannually, or annually. As long as an organization deals with financial and business transactions, regardless of its status as a government, not-for-profit, etc., it is required to make these financial reports. The focus of this memo will primarily concern for-profit corporations.

Under the Financial Accounting Standards Board (FASB), the reporting of financial data should follow Generally Accepted Accounting Principles (GAAP) and must follow U.S. law. Though violation of GAAP does not necessarily breach U.S. law, most corporations follow them as if they were the law. Infringing securities policies typically results in heavy penalties; in 2016, technology manufacturer Logitech International was forced to pay a fine of $7.5 million for inflating its 2011 fiscal year financial results (U.S. Securities and Exchange Commission 2020).

Financial reports can be exceptionally easy to manipulate to misrepresent the health and stability of a corporation. Thus, the Securities and Exchange Committee (SEC) and the FASB tend to set relatively strict conditions for accountants to follow. For example, when journalizing and adjusting changes in a notes payable account, accountants are required to only use the accrual basis rather than the cash basis as to not over/understate their assets or liabilities (Tuovila 2020).

The stringency of laws is generally true across the accounting cycle – there is often no more than one acceptable method to record financial information and data. However, an exception does exist in the procedures of recording inventory. GAAP allows for three different methods of accounting for inventory costs: the First-In-First-Out (FIFO) method, the Last-In-First-Out (FIFO) method, and the Average-cost method. These methods are relatively self-explanatory: FIFO assumes that the first inventory to arrive is the first to be sold, LIFO assumes that the last inventory to arrive is the first to be sold, and the Average-cost method assumes that the cost of the inventory sold is taken from a weighted average over all goods sold over the financial period.

Different inventories purchased at different times can have a different cost. That is, if an order of ten toasters was purchased at $400 dollars in January, it would not be uncommon for a corporation to purchase 20 toasters at $900 dollars later on in July. From a basic mathematical standpoint, it is clear to see that the different methods of recording inventory would result in different values: if the company managed to sell 15 toasters by the end of July, under the FIFO method the total cost of goods sold would be $625, as opposed to $675 if the LIFO method was used.

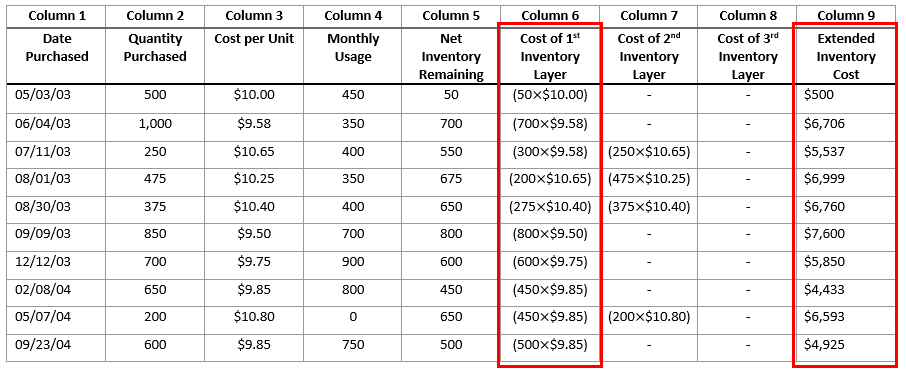

Clearly, the cost of goods sold is not a static figure. Over the course of a financial period, the cost of inventory sold at different times will rarely be the same; different quantities of inventory may be sold for different prices. Columns 6 & 9 in the table below illustrate this for a FIFO valuation example (Bragg 2005):

Figure 1: FIFO Valuation Example

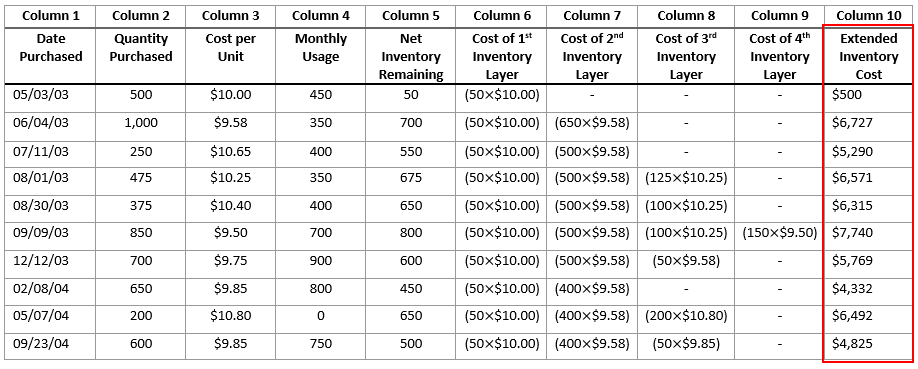

When comparing to a FIFO valuation to LIFO valuation, particularly with examples with identical values (Bragg 2005), discrepancies in ending inventory costs become clear (note the comparison between column 9 for the FIFO valuation above with column 10 for the LIFO valuation below):

Figure 2: LIFO Valuation Example

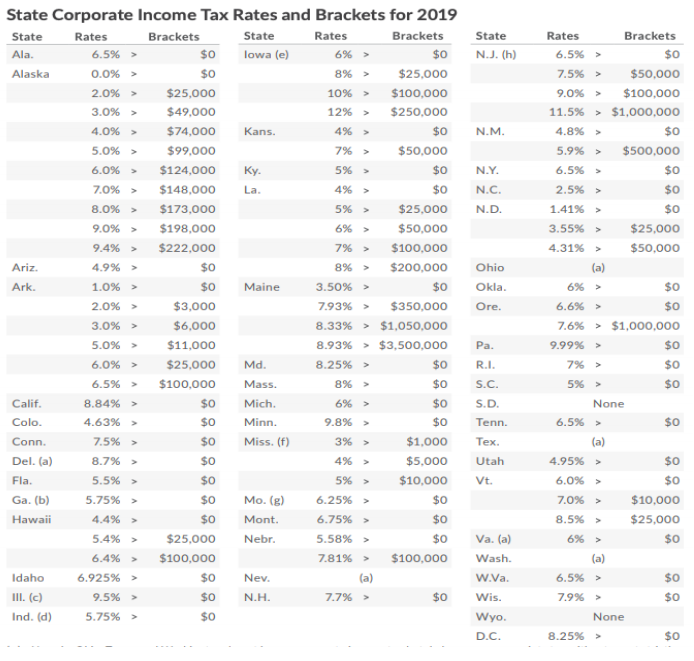

Assuming the LIFO valuation method typically results in higher costs of goods sold. Higher costs of goods sold adds to the total expenses account of a company, reducing gross profits. Profit is calculated by reducing costs expenses from revenues – in this case, revenues are generated through selling inventory. The primary reason for American companies to use LIFO valuation methods over FIFO valuation methods is to represent their financial status as less profitable, potentially lowering the amount of taxes paid (Davenport 2002). The state corporate income tax rate for 2019 with its respective income bracket tax rates can be seen below (Cammengo 2020):

Figure 3: State Corporate Income Tax Rates for 2019

Evidently, the choice to use LIFO evaluation methods can misrepresent financial information to the benefit of a corporation – revenues are understated to reduce taxable profits.

Recommendation: Standardize Inventory Cost Valuation to a Single Method

U.S. companies will continue to use LIFO valuation methods for tax purposes. In periods of inflation, the LIFO method will reduce taxes payable, often making it the clear choice for the benefit of a company. However, by standardizing inventory cost valuation methods to the FIFO method, we can effectively:

- Prevent abuse of tax policies. Graduated tax policies aim to reduce wealth disparities. FIFO valuation methods reduce the risk of already affluent corporations from abusing tax loopholes.

- Provide consistency in a global context. Under the International Financial Reporting Standards (IFRS), corporations in most countries outside the United States are required to use the FIFO method (Craycraft 1998). Oftentimes, corporations in the U.S. using LIFO will swap to FIFO when operating overseas. By mandating American companies to use the FIFO method, less confusion in international business transactions is created.

- Lessen risk of outdated costs in inventory (Bragg 2005). As the FIFO method utilizes the oldest costs first to calculate the total cost of goods sold, it is impossible to have outdated costs to accumulate in inventory. Management branches in corporations will not have to worry about outdated prices significantly influencing the cost of goods sold and subsequently, violations of GAAP.

- Lessen interference with just-in-time systems (Bragg 2005). Just-in-time (JIT) systems are a management strategy which essentially uses raw materials in lieu with production schedules, that is, utilizing resources only when they are needed (Banton 2020). Intuitively, the LIFO method can be problematic when JIT systems are being used. It is important to note that JIT systems are highly efficient and are being employed by increasing numbers of corporations today.

The impact of this policy change will mostly affect a corporation’s operations within the United States as regulations under the IFRS already mandate the FIFO cost allocation method. The standardization of the FIFO method will immediately decrease the reported costs of goods sold and concurrently increase the reported profit of corporations using LIFO cost allocation methods. Government revenue from corporate taxation will consequently increase.

Holistically speaking, unless there is a significant discrepancy of the price of inventory purchased at the start of a financial period as compared to the end of the financial period, this change will not hugely impact a corporation in the long run. Inventory is not a long-term asset, that is, it is expected to be turned over during a single accounting period or a single year, whichever is shorter. Essentially, this policy change does not significantly impact the operations of for-profit corporations while effectively lessening the risk of tax abuse and accounting standards violations. It can also alternatively streamline operations within companies that use JIT management strategies.

A similar policy memorandum was made by the Congressional Budget Office (CBO) in 2013. The CBO proposed to eliminate the LIFO approach to identifying inventory, as well as “lower of cost or market” (LCM) and subnormal-goods methods of inventory valuation. The Joint Committee on Taxation estimated an increase of $58 billion in taxable revenues from 2019-2028. CBO estimates that the annual increase in revenues would be “substantially” higher in 2019-2023 than the remaining 10 years; following the completion of inventory re-evaluation, the effect on revenues would be relatively small (Congressional Budget Office 2020).

Conclusion

In consideration of the fact that GAAP generally mandates no more than one method of accounting for financial data, that FIFO is used as an international standard, and that different inventory presentation methods result in potentially misleading and confusing information, inventory valuation methods should be restricted to a single, universal standard. LIFO valuation systems only serve the benefit of reducing taxes payable for companies. Otherwise, using the LIFO method can increase GAAP violation risk through confusion in inventory accounts and does not work well with other systems within the accounting cycle.

Bibliography

Craycraft, Catherine. “Foreign Operations and the Choice of Inventory Accounting Methods.” Journal of International Accounting, Auditing and Taxation 7, no. 1 (1998): 81-93.

Davenport, Charles. The Income Taxation of Inventories Under the Last-In-First-Out Method. Lewiston, N.Y.: Edwin Mellen Press, 2002.

Banton, Caroline. Just-In-Time (JIC). Investopedia. Accessed March 9, 2020.

https://www.investopedia.com/terms/j/jit.asp.

Tuovila, Alicia. Accruals. Investopedia. Accessed March 8, 2020. https://www.investopedia.com/terms/a/accruals.asp

Cammenga, Janelle. State Corporate Income Tax Rates and Brackets for 2019. Tax Foundation. Accessed March 9, 2020. https://taxfoundation.org/state-corporate-rates- brackets-2019/.

Repeal the “LIFO” and “Lower Cost or Market” Inventory Accounting Methods. Congressional Budget Office. Accessed April 5, 2020. https://cbo.gov/budget- options/2018/54812

SEC Announces Financial Fraud Cases. U.S. Securities and Exchange Commission. Accessed April 5, 2020. https://www.sec.gov/news/pressrelease/2016-74.html